So, you wish to study a model new talent fast—maybe it’s juggling flaming torches (hopefully not), coding in Python, and even mastering the artwork of constructing the right espresso. Whatever it is, the good news is that fast ability acquisition isn’t just for prodigies or superheroes. Now, there are methods to skim and scan by way of books that let you study faster with wrecking your focus, but they’re not a replacement for being a completionist more usually than not. That’s why it’s essential to review in ways in which truly ensure you’ll keep in mind what you examine. And the finest way to select up new skills is to act as if you’ll be studying them endlessly.

Consider its relevance to your current wants or future aspirations. Ensure that the talent is sensible and will add worth to your private or profession growth. While speed is essential, true learning emphasizes understanding and flexibility, enabling artistic and long-term software. By maintaining focus, overcoming challenges actively, and refining constantly, you’ll find a way to speed up ability acquisition with out sacrificing depth or expertise.

When you first learn something (or watch a video), all the data is new to you, and explicit problems are prime of thoughts for you. And hey, getting help from a coach makes this even sooner; they steer you proper when things get twisty. They grab onto new concepts, perceive them, and use them in numerous methods. A mental representation reveals you “what you might be supposed to be doing.” Mental representations make it potential to observe how one is doing, each in apply and in actual efficiency. For example, in music, mental representation permits expert musicians to duplicate the sounds of a bit that they wish to produce whereas they play.

To become smarter, it’s more about the capability to be taught faster, rather than being a natural born genius. Live your finest life by studying tips on how to learn any talent fast. Therefore, an important a part of learning a new talent is being snug with not figuring out, and making an attempt to avoid feeling self-conscious. In addition, settle for that making mistakes–lots of them–is simply part of the training course of. When you’re learning a new skill, you’re changing your brain. If that is the case for the ability that you want to study, comply with the training process that’s already working for others.

Embracing your most popular studying fashion lets you tap into your strengths and obtain your academic objectives extra effectively. Embracing your most popular studying type allows you to faucet into your strengths and maximize your learning experience. By recognizing the way you learn best, you’ll be able to tailor your academic strategy to suit your individual wants and targets. This self-awareness empowers you to optimize your studying and unlock your full potential. Aural learners, however, thrive via sound and music.

My brain is fried from having to cram all of that data on Gilgamesh and the Middle Ages simply hours before the exam. And inside minutes it seems like I had forgotten everything I memorized. I passed my examination but I didn’t be taught something about “how historic and medieval ideas offered the inspiration for the modern world”, one of the major learning outcomes of the course. Public speaking builds social confidence, teaches you to communicate clearly, and helps you inspire others. Whether you’re presenting, main a gathering, instructing, or simply holding better conversations, it’s one of the most worthwhile skills you can study.

But quite than finding out for four hours straight, you’ll probably make more progress should you build in a bunch of short breaks to give your mind time to get well. This one might seem obvious, but a lot of on-line learning platforms don’t really require it. Watching a video of someone else doing something can help you higher perceive the skill, but to actually grasp it, you in all probability have to go hands-on and actually do it your self. Journalist Malcolm Gladwell, in his book “Outliers,” launched a compelling concept about what it takes to turn out to be an skilled in any area. According to Gladwell, you have to dedicate approximately 10,000 hours to truly grasp something.

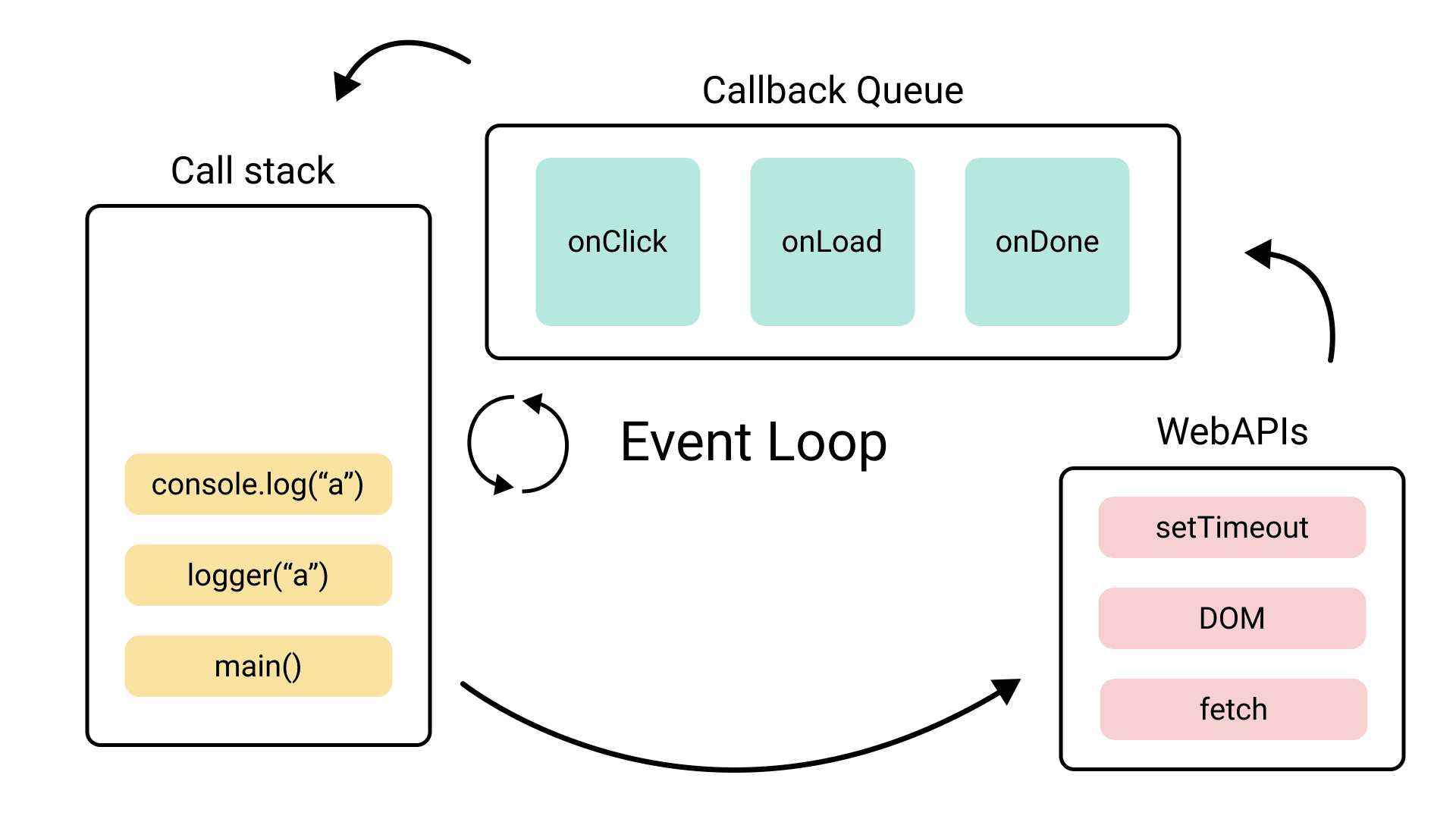

Mind mapping is a visible approach used to organize info in a method that’s easier to know and remember. By making a mind map, you can visually connect related ideas, making it simpler to see the “big picture” of what you’re studying. One of the key factors in velocity studying is neuroplasticity—the brain’s capability to reorganize itself by forming new neural connections. When you learn something new, your brain creates pathways that make it easier to entry that info sooner or later.

Use your CV, cowl letter, and interview responses to focus on your ability to learn shortly and contribute value. Fast learners could complete duties rapidly however battle when faced with new challenges that require adaptability and problem-solving. Quick learners, nonetheless, develop skills that permit them to regulate to completely different environments, integrate information meaningfully, and repeatedly improve their expertise.

Researchers on the University of Reading have found that eating blueberries improves each short-term and long-term memory (Whyte, A. Periodic review is crucial if you need to transfer info from your short-term memory to your long-term reminiscence. After all, you may have so many assignments to do, initiatives to work on, and checks to review for. And sure, practical exposure isn’t alone sufficient to validate whether or not you are going heading in the proper direction and have become proficient with the particular know-how or not.

Keep picturing the enjoyment of reaching the top aim and being a better version of your self as continuous motivation. Obviously, these within the second group are much extra likely to persevere when learning new skills. Therefore, in order to imagine you could learn the skill that you’re trying to develop, adopt a progress mindset. For instance, if you’re studying a musical instrument, dedicate half-hour daily to apply scales, chords, or particular songs. If you’re learning coding, try solving small coding problems daily. The extra consistent you may be, the quicker you’ll improve, and the skill will start to turn out to be second nature.

We hear so much about mental rehearsal, and we all the time take into consideration psychological rehearsal because the thing you do before you train or as a substitute of coaching. We did a complete 4 episodes on sleep and how to get higher at sleeping. Those were the episodes back in January — episodes, primarily, one, two, three, and four, and perhaps even episode 5, I don’t recall. But you can go there to search out out all about tips on how to get better at sleeping.

In learning PHP, I began by downloading well-built WordPress plugins. By taking a look at their code, I might get a better really feel for formatting and sequencing. Then, I would try to rewrite snippets of the plugin from reminiscence and evaluate my outcome to the completed product. As a result, I was in a place to study while working in a real-world surroundings. When you’re unfamiliar with a ability, it can be exceptionally onerous to find out which elements of a specific ability are price learning proper off the bat.

Reflect on your learning experiences, determine areas for growth, and seek out new sources or methods to assist your learning journey. Stay open to new ideas and approaches and be prepared to adapt as needed. Applying the talent in practical methods reinforces your studying and solidifies your understanding. Seek alternatives to follow and use the skill in real-life conditions. No, making errors is a standard part of the learning process.

It’s even exhausting for me to say it in a fair tone, but you get the concept. So a singular tone — simply think, a doorbell being rung with every press of the key — will be really annoying. So what Claudia Lappe and colleagues showed was that if people are making an attempt to be taught a sequence of keys on the piano, there are a number of forms of feedback.

I really have additionally been requested if I can be keen to volunteer in the classroom at occasions as a outcome of I understand the educating strategies. Discover practical tips to improve your enthusiasm, increase your motivation, and find pleasure in on a regular basis actions. Learn how to cultivate optimistic energy and embrace a extra fulfilling life. Learn the means to play the snare drum from scratch with this comprehensive guide. Discover important strategies, practice tips, and sources for beginners. Don’t be afraid to ask for feedback from mentors, lecturers, or friends.

And if you’re thinking about rising the audience on your podcast, you’ll have to study some primary advertising abilities. If you do choose self-learning, attempt to a minimal of find a knowledgeable friend to buddy up to make certain that you’re on the proper track. For instance, if you’re thinking of taking an online Spanish language class; try to take advantage of any Spanish-speaking pals to test out your conversational expertise.

Regularly take time to assess what you’ve got discovered, what’s working well, and what might be improved. Reflecting on your experiences helps you understand your learning style and preferences, enabling you to tailor future studying endeavors extra successfully. It additionally reinforces what you’ve realized, making it simpler to use your new abilities when necessary. Mentors and supervisors provide priceless insights into my work and efficiency. Peers provide completely different perspectives and identify areas for improvement that I would possibly overlook. Self-assessment, via common reflection and apply, also plays a vital function.

There will be instances whenever you face challenges, and that’s completely okay. Be affected person with your self and deal with errors as learning alternatives. Ask for feedback from colleagues, mentors, or academics to boost your abilities.

By understanding these cognitive processes, learners can tailor their research habits to align with how their minds work finest, ultimately leading to more practical talent acquisition. Cognitive processes refer to the psychological actions concerned in buying knowledge and understanding by way of thought, experience, and the senses. These processes embody consideration, reminiscence, and reasoning, all of that are important for effective studying. It additionally helps to do things like go to occasions about your ability, podcasts, music and even movies. Anything that may hep get you within the mindset of being good at that talent. Learning new issues is helpful at any age, and it can change your life in many ways—from providing you with a profession increase to helping you uncover a brand new passion.

So far you’ve performed preliminary research on your ability, perhaps you’ve requested someone who’s good at the skill for some input, and you’ve watched a couple of people performing the ability. In addition, based mostly in your analysis, you’ve deconstructed the ability and you’ve indentified the important thing parts of that talent. When you select a ability that you just need to study, you have to write down your objective as a aim assertion. However, you want to ensure that the goal is restricted, and never imprecise. Skills in AI, knowledge analysis, digital marketing, cybersecurity, and adaptability are considered future-proof. Soft expertise like creativity, leadership, and emotional intelligence additionally remain crucial.

One widespread false impression about studying is that its high quality is decided by money spent. In actual life, the impact of schooling is decided by how effectively funds are used, not just the amount paid. There can additionally be a suggestion that individual lessons are at all times higher than group classes.

To accomplish that, one could use documentation, discover answers in ChatGPT, or do reverse engineering in case of an open-source project. Use pleasant, open terms like Ready to Learn, Eager to Learn, or Keen to Improve. Once you reach the interview part, be sure you put together totally.

Attempting to show a talent accelerates personal mastery by forcing conceptual readability. The strategy of explaining ideas to others reveals information gaps which may otherwise remain unidentified. While standard approaches often emphasize consuming tutorial material, deliberate practice focuses on structured attempts to carry out the goal talent with instant suggestions.

Join tens of millions of individuals who organize work and life with Todoist. Join millions of individuals that get pleasure from peace of thoughts, and getting things carried out. The strategy of wanting on the ultimate product of your ability and backtracking to search out the greatest way to begin a task. In college, your academics were answerable for building lesson plans and making sure you had been headed in the best course. That could be a daunting prospect when you’re simply getting started.

Pay shut consideration to suggestions and use it to improve performance. Getting began – Make positive the talent both solves a problem you’re going through or is immediately applicable to your life. Groups offer several benefits when you’re choosing up something new like access to a collective knowledge-base and a spot to vent your frustrations. Research reveals that people working in teams felt larger intrinsic motivation and, consequently, have been extra prone to persevere at troublesome tasks. Sharing your targets with a detailed good friend and even your whole social network can help hold you accountable. A research published by New York University demonstrated after we inform somebody about a aim, we assume a “premature sense of completeness regarding the…goal.” We unknowingly ease up.

In distinction, specializing in the instant enjoyment of studying a brand new skill actually makes us more likely to keep it up. Incorporating mindfulness and meditation into your daily routine can significantly improve your capability to focus and retain information. In the next chapter, we’ll focus on how active studying methods can pace up the educational process and enhance your retention of recent material. One of the simplest methods for retaining information long-term is spaced repetition.

Choose the sources which would possibly be most engaging, accessible, and reasonably priced for you. Before you dive into studying a brand new talent, you should assess your wants and objectives. What are the necessities and expectations of your employer or clients?

Often you’ll find a way to proceed to engage in the exercise whilst you do the double inhale, exhale, and it will just relieve itself that means. Referenced pain is probably going to be familiar to any of you who’ve ever read about the way to acknowledge heart assault. People who’ve coronary heart assaults will sometimes have ache on one side of their physique, the left arm. Sometimes people that have ache in a half of their back will all of a sudden additionally get ache of their shoulder or part of their face. This has to do with the truth that many of our nerves branch, that means they’re collateralized to totally different organs and areas of the physique.

Above all, doing so will also connect your listed skills with the work and development experiences you have to offer. There’s nothing mistaken with itemizing “quick learner” on your resume, but you’ll read soon how showing proof to again it up is extra useful. If you choose to listing you’re a “quick learner” on your software, think about adding similar phrasing so that it appears more than once. In abstract, expressing your fast-learning capability in your resume aligns with the calls for of today’s workplaces.

Self-paced video packages to improve speed, retention and focus. In order to develop your important considering abilities, you need to study the chances and penalties of your decisions by getting the different views of your problem, for example. To develop this talent, you can start with being conscious of your body signs. You can start to keep up comfortable eye contact during conversation and an open body place to improve communication higher when conversing.

Let’s dive into these necessary expertise and how they can form your future. Remember, anybody and everybody can be a fast learner—because speed learning isn’t a privilege you’re born with however a talent to grasp. And the way you unleash your inner genius is dependent upon having the best learning strategy at hand. Whether you’re making ready for a promotion, diving into the world of AI tools, or studying a model new language, these 5 techniques by Jim might help you turn out to be a faster learner. In today’s fast-paced world, employers value candidates who can shortly adapt and thrive in new environments.

There’s all types of, just unbelievable stuff that you can do with cerebellum. I talked in an earlier episode on neuroplasticity about how one can disrupt your vestibular world. In other words, by getting into modes of acceleration, shifting through space the place you are tilted in sure ways, it could open up the windows for plasticity in yet different ways. Now all this information is integrated there, however what most people do not tell us is that a lot of studying of motor sequences, of ability learning that contain timing occurs within the cerebellum. Now you presumably can’t actually use that information besides to know that after you study one thing fairly properly, it’s handed off or kind of handled by your cerebellum. But there’s something that you can do together with your cerebellum to increase range of motion and adaptability.

Good typing skills save time and make your writing clearer. This means you are able to do extra in less time, whether for work or personal tasks. You’ll begin typing about forty words per minute within the first weeks.

If we outline ineffective here as having zero or worse of an influence on your goals, then merely cutting this stuff away would have dramatic results. If your life sucks, it’s pretty evident that you’ll need it to vary. Likewise, if it’s amazing, you will have it to stay the same or get more amazing. This is why it’s critical to actually care about your work, relationships, success, your future, and the remainder of the laundry list. Find things in life that maintain your attention and that you just ENJOY doing. It’s a shameful thing to begin a conversation should you’re not genuinely excited about something.

Discover the secrets to profitable on-line courses and academic content material. This was a fairly arbitrary listing, and it’s undoubtedly much longer in reality. The level, nevertheless, is to not come up with the perfect record. The level is to make the broad aim of “learning to play guitar” into bite-sized expertise that you can investigate and follow.

It’s straightforward sufficient now to find folks which may be interested in the identical types of issues as you’re interested in, so benefit from it! Even should you just discover ONE one who is doing the same factor as you, you’ll find a way to launch eachother into success. It’s good to surround your self with quite a lot of individuals however make sure that you have a minimal of 2-3 individuals in your life who’re a LOT higher at the skill than you are. This retains you motivated, you’ll have the ability to ask them questions, they usually can encourage you to get higher. This may imply leaving your running shoes out the night earlier than, or leaving your martial arts outfit on the chair prepared so that you just can placed on. The level right here is to make it as easy as attainable to physically begin working towards.

Additionally, addressing students’ belongingness and esteem needs helps to create a positive and supportive classroom climate, fostering emotional well-being and academic success. In the context of education, Maslow’s Hierarchy of Needs is a priceless framework that emphasizes the importance of addressing students’ elementary needs to create a conducive studying environment. Discover efficient strategies and strategies on how to stay constructive, cultivate optimism, and enhance your overall well-being. By understanding these stages, you can tailor your studying approach to maximise your progress and achieve quicker results. Make certain you’re putting your new expertise into practice as soon as potential. The extra you use what you’ve realized, the extra probably it will stick.

Everybody likes the easier path in life and most of the time the simple path is to stop, to surrender and to relax on the sofa while watching Grey’s Anatomy. So after doing tons of analysis on-line, I’ve compiled an article that may greatest serve the aim of studying a new talent within the fastest most effective way potential. More importantly, nevertheless, is having experiences that help what you’re saying. If I see that phrase in a resume, I need to see proof in the work historical past that validates it – a monitor report of taking up new duties frequently and shortly throughout your profession. He recommends sharing your dedication to continuous learning.

A fast learner refers to someone who can simply and rapidly purchase new knowledge or abilities, adapt to new environments, and apply what they’ve realized in a sensible context. It’s an necessary trait for employers as a outcome of it signifies that a candidate will be succesful of deal with tasks efficiently and sustain with evolving demands. Your mind’s ability to kind new neural pathways (neuroplasticity) is the foundation of fast studying. Every time you practice a new skill, your mind strengthens present connections and creates new ones. The secret is maximizing this process by way of strategic practice. In an ever-evolving skilled landscape, the pursuit of data and ability development isn’t just useful however essential for career longevity and success.

For instance, Professor Todd Kashdan recently identified that anxious people are usually astoundingly creative and persistent when it comes to navigating obstacles. Personally, studying and self-development is my highest priority of the day. That method, if the relaxation of my day goes sideways, I know I’ve at least spent half-hour enhancing myself in some measurable method.

Up to 1200 milligrams every day, divided into three doses of four hundred milligrams, is what the studies that I was able to find present or used. The effects on cognitive decline are described as notable. Notable meaning a quantity of research confirmed a major but modest impact in offsetting cognitive decline. In particular, in older populations and some populations, even with some reported neurodegeneration. So we’ll talk about this in a second, about precisely how to do this and explore this.

Firstly, I assess my present skillset and identify any gaps that hinder my effectiveness or limit my career development. I take a look at my long-term goals and determine expertise that would significantly benefit my advancement. For example, if my long-term aim involves leadership, I may prioritize growing expertise in project administration, staff leadership, and communication. Measuring progress when studying a model new skill is essential for sustaining motivation and figuring out areas needing more focus. I use a mixture of methods to trace my studying journey. These milestones are SMART targets – Specific, Measurable, Achievable, Relevant, and Time-bound.

It’s the right place to free your self from all of the individuals who like to distract you. If you don’t have a library nearby, find a location or a room that isn’t too noisy so you probably can work with full focus and thus gain maximum leads to minimum time. I like to sleep, so I perceive your pain however you’re in all probability sleeping too much. It’s time to reduce back that sleep to make some extra time to develop a model new talent. Try being somewhat extra specific with what you are trying to do; the motivation to learn the new ability will kick proper in. Your talents space is one other opportunity to emphasize your accelerated learning fee.

When you find an method producing clear results, double down on it and remove the remaining. Suddenly, as an alternative of mastering this big, intimidating talent known as “public speaking,” you’ll have the ability to give consideration to improving your voice projection for three days, then work on storytelling for per week. With the big selection of abilities courses out there at City Lit, you can select a subject which helps you improve your professional skillset or permits you to pursue your passion. Discover our accredited courses together with hundreds of other City Lit programs designed to fast observe your studying.

And then I’m going to give you a really, what I assume is a really cool tool, that may improve flexibility and vary of movement primarily based on this particular mind area. It’s a software that I used, and after I first heard about I did not imagine would work. This is definitely anchored deeply in the biology of a particular mind area that all of us have, whose meaning is minibrain. And that minibrain that we all have known as your cerebellum. In any occasion, the metronome is a robust device, again for extra advanced practitioners, or for advanced intermediate practitioners. So for sprinting or swimming or working, where the objective is to generate extra strokes or more environment friendly strokes or more steps, et cetera.

Eventually I obtained pretty good at performing in entrance of family and friends, so I began reaching out to do paid gigs. Although, I most likely wasn’t ok to receives a commission for the magic I knew at the time (🤷♂️). The level was that by performing magic at different gigs and events, I significantly improved my skills in a way that wouldn’t have been possible if I caught to performing in front of the mirror. Let’s say we’re attempting to be taught one thing, like the guitar or a new sport.

Take it from Mindvalley member Daniel Ford, a Minneapolis-based writer, who felt “stuck in an endless loop of self-development” without making actual progress. After making use of Jim’s techniques, he discovered to unlock new ways of considering that ultimately moved him to launch a platform for increasing cognitive potential with AI. As Jim emphasizes in Superbrain, recovery time is just as important as the best learning strategy. “Breaks give your mind space to process what you’ve just learned,” he says.

Persistence is important, continue training and learning, and your efforts will eventually lead to success. To discover ways to write in Japanese, one of the best device for the job could be a Japanese grammar textbook. But if you want to improve your listening and verbal skills, studying a textbook won’t be as effective as chatting with a local speaker. Once you’ve realized a talent, put it to use, master it, and alter your self. This will assist somebody learns and can make their learning lasting.

If you’re struggling to make progress in learning any talent, these verified skilled tips about successfully mastering a brand new ability shall be extraordinarily helpful. These suggestions have been mentioned by industry specialists, in dialogue forums, and by renowned polymaths like Leonardo Da Vinci who mastered virtually every talent they determined to be taught. Being an ‘efficient learner’ means you’re good at getting to grips with and using new info effectively.

Identify someone who embodies your ambitions for the approaching years and research their journey. For instance, when you purpose to be a successful entrepreneur, follow the career paths of leaders like Elon Musk or Sara Blakely. Analyze their key decisions, examine how they overcame obstacles, and adapt these rules to your individual circumstances.

Imagine operating a enterprise at present with out understanding social media algorithms or web optimization (search engine optimization). You would be missing out on some of the powerful instruments for rising your corporation. By learning the basics of digital advertising, you can construct your strategies and even scale back your reliance on exterior professionals. As an entrepreneur, studying isn’t just something you do at college or university—it’s a lifelong course of.

I first try to troubleshoot independently using out there assets (documentation, tutorials, on-line forums). If this fails, I identify a relevant professional – a colleague, mentor, or online community member – and articulate my specific downside clearly and concisely. I’ll typically prepare a short summary of what I’ve already tried and where I’m caught. This ensures efficient use of their time and helps them pinpoint the exact issue I’m facing. I imagine in collaborative studying and discover that framing my questions in a selected means results in more practical problem-solving. Motivation is the inner drive and vitality that pushes people to set goals, take motion, and persist in reaching objectives regardless of challenges or setbacks.

So don’t attempt to study whereas additionally intermittently replying to textual content messages, watching TV, and checking your Twitter feed. Of course, you won’t have the power to do all of these items in a single sitting. But every time you review the subject, use a special useful resource or technique – you’ll study faster this fashion. For instance, when you’re studying Data Structure or a model new programming language, you might be strongly beneficial to participate within the coding challenges and hackathons to check and showcase your expertise.

Getting a trainer will certainly value you some cash, but in case you are studying one thing new and useful in the cut price then cash shouldn’t be a criterion in any respect. So ensure that you rent not just any or everybody but a proper educated professional. When attempting to select up and be taught a skill it is important that from the very onset you understand that things are not going to be straightforward.

They can present insights and feedback that formal studying often doesn’t provide. Entrepreneurs typically operate on limited budgets, particularly in the early phases. Whether it’s mastering fundamental accounting, advertising, or coding, acquiring these expertise may help you scale back reliance on costly exterior professionals. As an entrepreneur, learning these abilities as they turn into related can be the distinction between success and failure. Staying stagnant isn’t an possibility, and the ability to study shortly could probably be your secret weapon. Silence your cellphone, use web site blockers, and create a clean, targeted research house.

Clearly, I do not know something about horses except that they’re beautiful and I like them very much, but they break into a unique sort of stride. And that’s because you shift over to totally different central pattern turbines. Like there’s something about maintaining with a timer or with a tempo that, presumably, and I’m speculating right here, causes the release of explicit chemical compounds. Metronomes, they’re completely inexpensive, a minimum of those that you just use outdoors of water are very inexpensive. You can discover these free apps, you have to use a musical metronome.

Reframing the data in your own words helps you keep the data longer, that means you’ll have higher recall and can carry out better on exams. Neuroscience has taught us so much about how our brains process and hold on to information. Remember, your alternative of words can paint a vivid image of your skills and make hiring managers notice you. Use this guide to tweak your resume and show that you’re not simply any candidate—you’re the right one for the job.

Here are a number of key concepts to hold in mind when trying to study a brand new skill as quickly as potential. You speed up your learning curve by zeroing in on areas of weakness and making use of deliberate, focused follow. The remaining 20% of learning should come from networking and mentorship. Surround yourself with individuals who have the abilities you wish to be taught.

Procrastination is a standard hurdle that many face when attempting to learn a model new skill. It usually stems from concern of failure, perfectionism, or simply feeling overwhelmed by the task at hand. To combat procrastination, it’s important to grasp its root causes and implement efficient methods. Skills like coding are in demand within the tech world, and you’ll learn them for free online. You also can be taught primary martial arts for self-defense, tips on how to tailor garments, or even break an apple along with your hands in per week.

To learn quickly and effectively, start by figuring out the 20% of the ideas that provides you with 80% of the understanding—this is called the Pareto Principle. It isn’t merely the formidable, quite it is all of us, who want to move forward in life and achieve success. If you want to turn out to be profitable, then you should all the time attempt to improve yourself as nicely as the abilities which you have.